Frank Lampard has doffed his proverbial cap to Fabio Capello, highlighting England's progress from European Championship drop-outs to World Cup contenders under the Italian.

Capello took charge of a team at its lowest ebb in the wake of Steve McClaren's disastrous reign, but just under two years later they head to South Africa 2010 in high spirits after a barnstorming qualifying campaign.

Lampard said in The Mirror: “We’ve come a very long way under the manager. Our confidence was rock bottom from not qualifying [for Euro 2008].

“For England not to qualify for a major tournament, I know It’s happened quite a few times over the years, but it is a low point.

“We’re a top nation with top players and we should be qualifying. We were on the floor almost.”

England won nine out of their ten qualifiers to coast into football's showpiece event in atypically smooth fashion, bypassing the last-gasp heroics that has characterised previous campaigns.

And although confidence is sky high in the Three Lions camp, Lampard warns that the bar will have to be raised once more if he and his countrymen are to achieve anything next summer.

“Credit to the manager and to all the players as well, and we turned it around and qualified in style,” said the Chelsea midfielder.

“And again now it’s time to get the extra 10 per cent and go to the World Cup and have a right go at it.”

Frank Lampard has doffed his proverbial cap to Fabio Capello, highlighting England's progress from European Championship drop-outs to World Cup contenders under the Italian.

Capello took charge of a team at its lowest ebb in the wake of Steve McClaren's disastrous reign, but just under two years later they head to South Africa 2010 in high spirits after a barnstorming qualifying campaign.

Lampard said in The Mirror: “We’ve come a very long way under the manager. Our confidence was rock bottom from not qualifying [for Euro 2008].

“For England not to qualify for a major tournament, I know It’s happened quite a few times over the years, but it is a low point.

“We’re a top nation with top players and we should be qualifying. We were on the floor almost.”

England won nine out of their ten qualifiers to coast into football's showpiece event in atypically smooth fashion, bypassing the last-gasp heroics that has characterised previous campaigns.

And although confidence is sky high in the Three Lions camp, Lampard warns that the bar will have to be raised once more if he and his countrymen are to achieve anything next summer.

“Credit to the manager and to all the players as well, and we turned it around and qualified in style,” said the Chelsea midfielder.

“And again now it’s time to get the extra 10 per cent and go to the World Cup and have a right go at it.”

Labels

- 010 (2)

- best gay show (6)

- gay get fuck (5)

- gay love gay (4)

- gellary 01 (3)

- gellary 010 (1)

- gellary 011 (3)

- gellary 012 (3)

- gellary 02 (3)

- gellary 03 (2)

- gellary 04 (2)

- gellary 05 (2)

- gellary 06 (2)

- gellary 07 (2)

- gellary 08 (1)

- gellary 09 (1)

- gellary 1 (1)

- gellary 10 (2)

- gellary 11 (1)

- gellary 12 (1)

- gellary 13 (1)

- gellary 14 (1)

- gellary 15 (1)

- gellary 16 (2)

- gellary 17 (1)

- gellary 18 (1)

- gellary 19 (1)

- gellary 2 (1)

- gellary 20 (1)

- gellary 3 (1)

- gellary 4 (1)

- gellary 5 (1)

- gellary 6 (1)

- gellary 7 (1)

- gellary 8 (1)

- gellary 9 (1)

- khmer magazine (5)

- small boy show (3)

- teen gay (6)

- teen gay fucking (1)

- teen gay show (3)

- teen gay show 1 (3)

- teen gay show 2 (4)

- teen gay show 3 (4)

- teen gay show 4 (3)

- video 01 (5)

- video 02 (4)

- video 03 (6)

- video 04 (4)

- video 05 (3)

- video 06 (3)

- video 07 (3)

- video 08 (3)

- video 09 (4)

- video 1 (4)

- video 10 (6)

- video 2 (5)

- video 3 (4)

- video 4 (5)

- video 5 (7)

- video 6 (6)

- video 7 (6)

- video 8 (5)

- video 9 (5)

- worldbusiness (10)

- worldnews (18)

- worldsport (10)

Frank Lampard has doffed his proverbial cap to Fabio Capello, highlighting England's progress from European Championship drop-outs to World Cup contenders under the Italian.

Capello took charge of a team at its lowest ebb in the wake of Steve McClaren's disastrous reign, but just under two years later they head to South Africa 2010 in high spirits after a barnstorming qualifying campaign.

Lampard said in The Mirror: “We’ve come a very long way under the manager. Our confidence was rock bottom from not qualifying [for Euro 2008].

“For England not to qualify for a major tournament, I know It’s happened quite a few times over the years, but it is a low point.

“We’re a top nation with top players and we should be qualifying. We were on the floor almost.”

England won nine out of their ten qualifiers to coast into football's showpiece event in atypically smooth fashion, bypassing the last-gasp heroics that has characterised previous campaigns.

And although confidence is sky high in the Three Lions camp, Lampard warns that the bar will have to be raised once more if he and his countrymen are to achieve anything next summer.

“Credit to the manager and to all the players as well, and we turned it around and qualified in style,” said the Chelsea midfielder.

“And again now it’s time to get the extra 10 per cent and go to the World Cup and have a right go at it.”

Frank Lampard has doffed his proverbial cap to Fabio Capello, highlighting England's progress from European Championship drop-outs to World Cup contenders under the Italian.

Capello took charge of a team at its lowest ebb in the wake of Steve McClaren's disastrous reign, but just under two years later they head to South Africa 2010 in high spirits after a barnstorming qualifying campaign.

Lampard said in The Mirror: “We’ve come a very long way under the manager. Our confidence was rock bottom from not qualifying [for Euro 2008].

“For England not to qualify for a major tournament, I know It’s happened quite a few times over the years, but it is a low point.

“We’re a top nation with top players and we should be qualifying. We were on the floor almost.”

England won nine out of their ten qualifiers to coast into football's showpiece event in atypically smooth fashion, bypassing the last-gasp heroics that has characterised previous campaigns.

And although confidence is sky high in the Three Lions camp, Lampard warns that the bar will have to be raised once more if he and his countrymen are to achieve anything next summer.

“Credit to the manager and to all the players as well, and we turned it around and qualified in style,” said the Chelsea midfielder.

“And again now it’s time to get the extra 10 per cent and go to the World Cup and have a right go at it.”

Japan's Nikkei index edges up but gains limited

TOKYO—Japan's benchmark stock index rose Friday, but gains were limited on concern over ballooning government debt and uncertainty over the restructuring of struggling Japan Airlines Corp.

The Nikkei 225 index edged up 18.91 points, or 0.2 percent, to 10,257.56. During the week, the key stock index gained 2.4 percent. The broader Topix index slipped 0.3 percent to 900.95.

"Sentiment remained downbeat as investors were worried that the government may have to issue more bonds for the budget" in the coming fiscal year to March 2011, said Masashi Sato, market analyst at Mizuho Investors Securities Co. Ltd.

Prime Minister Yukio Hatoyama, who took office last month, pledged to cut wasteful government spending. But reports said the size of the next fiscal year's budget could hit a record 95 trillion yen ($1.2 trillion) with the issuance of massive deficit-covering bonds.

"Despite a weakening yen, which could boost export-linked shares, investors were reluctant to buy shares due to uncertainty over the new government's handling of the economy," Sato said.

The market was also unnerved by uncertainty over the restructuring of struggling Japan Airlines Corp., which has asked for a government bailout.

Among blue chips, Toyota Motor Corp., the world's biggest automaker, was unchanged at 3,620 yen.

Honda Motor Co. lost 1.1 percent to 2,780 yen. Nissan Motor Co. shed 0.7 percent to 672 yen. Sony Corp. added 1.9 percent to 2,650 yen.

Japan Airlines plunged 11 percent to 101 yen.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Balloon boy's' family deny publicity stunt

The balloon moments after landing in Colorado. Inset: Falcon Heene.

FORT COLLINS, Colorado - A 6-year-old boy was found hiding in a cardboard box in his family's garage Thursday after being feared aboard a homemade helium balloon that hurtled 50 miles (80 kilometers) through the sky on live television.

The discovery marked a bizarre end to a saga that started when the giant silvery balloon floated away from the family's yard Thursday morning, sparking a frantic rescue operation that involved military helicopters and briefly halted some departures from Denver International Airport.

Then, more than two hours after the balloon gently touched down in a field with no sign of the boy, Sheriff Jim Alderden turned to reporters during a news conference, gave a thumbs up and said 6-year-old Falcon Heene was "at the house."

"Apparently he's been there the whole time," he said.

The boy's father, Richard Heene, said the family was tinkering with the balloon Thursday and that he scolded Falcon for getting inside a compartment on the craft.

He said Falcon's brother saw him inside the compartment and that's why they thought he was aboard the balloon when it launched.

But the boy had fled to the garage, climbing a pole into the rafters and hiding in a cardboard box, at some point after the scolding. He was never in the balloon during its two-hour, 50-mile (80-kilometer) journey through two counties. "I yelled at him. I'm really sorry I yelled at him," Heene said, choking up and hugging Falcon to him during a news conference.

"I was in the attic and he scared me because he yelled at me," Falcon said. "That's why I went in the attic."

Heene said the balloon wasn't tethered properly, and "it was a mishap. I'm not going to lay blame on anybody."

The boys' parents are storm chasers who appeared twice in the ABC reality show "Wife Swap," most recently in March.

Richard Heene adamantly denied the notion that the whole thing was a big publicity stunt. "That's horrible after the crap we just went through. No."

During a live interview with CNN, Falcon said he had heard his family calling his name.

"You did?" Mayumi Heene said.

"Why didn't you come out?" Richard Heene said.

Falcon answered, "You had said that we did this for a show."

Later, Richard Heene bristled when the family was asked to clarify and said he didn't know what his son meant. He didn't ask his son what he meant by "a show."

The sheriff said he would meet with investigators on Friday to see if the case warranted further investigation.

"As this point there's no indication that this was a hoax," Alderden said.

The flying saucer-like craft tipped precariously at times before gliding to the ground in a dirt field 12 miles (20 kilometers) northeast of Denver International Airport. Sheriff's deputies secured it to keep it in place, tossing shovelfuls of dirt on one edge.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Ancelotti: Drogba can be the best

This time last year, Chelsea striker Didier Drogba was in the midst of a miserably long sulk that gave his army of critics plenty of fresh ammunition to fire in his direction.

Drogba is a big part of Ancelotti's plans.

The Ivorian has a reputation for playacting that precedes him.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Goldman, Citi Earnings Reports Mixed

Goldman Sachs Took in $3B in 3rd Quarter, but Citi Reports Billions in Failed Loans

-

Jack Hough, Columnist for SmartMoney.com and author of "Your Next Great Stock," discusses the Dow Jones Industrial Average topping 10,000 again and what it could mean for the economy.

-

The headquarters of investment firm Goldman Sachs towers over smaller buildings in New York in this Dec. 11, 2006 file photo.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Liberals, Lay Off Obama

He’s on his way to an historic health-care win. The stimulus was huge. The market’s back. The left should stop complaining the president hasn’t accomplished anything.

He’s on his way to an historic health-care win. The stimulus was huge. The market’s back. The left should stop complaining the president hasn’t accomplished anything. Maybe that Saturday Night Live skit wasn’t so funny after all. Four days after Fred Armisen announced that Barack Obama’s signature accomplishments were “jack” and “squat,” our do-nothing president did something that Democratic presidents have been trying to do for most of the last century: He celebrated a universal health care bill’s passage through Senate Committee. For good measure, the Dow topped 10,000 for the first time since last fall’s meltdown. Obama’s polling has even ticked up: According to Gallup, he’s more popular than he’s been since summer.

If he gets health-care reform, Obama will have done more to rebuild the American welfare state in one year than his two Democratic predecessors, Jimmy Carter and Bill Clinton, did in a combined twelve.

Get ready for the “Obama comeback” stories, in which the same publications that recently declared that “he’s failing miserably” (Politico) and “suddenly looking unsure of himself” (The Economist) discover that he’s thriving again. But the boring truth is that he was pretty much thriving all along. Journalists are non-fiction script-writers. They need plot-twists: Barack meets public; Barack loses public; Barack regains public. Bill Clinton was great this way: Whenever things were getting monotonous, he’d grope an intern just to make life interesting. Obama, on the other hand, is relentlessly disciplined, pragmatic, and successful. Beneath the fascinating exterior, he’s dull as hell.

And it’s not just that Obama is predictable. Politically, we live in fairly predictable times. The demographic shifts that have put the Democrats in power—more young voters, more Hispanic voters, more highly-educated voters—have been decades in the making, and aren’t likely to reverse themselves anytime soon. Nor are voters likely to forget George W. Bush. Obama is blessed to have taken office in the aftermath of disaster—which means that he’ll probably be judged against a low bar. When Franklin Roosevelt ran for reelection in 1936, unemployment was still 17 percent, but it was no longer 25 percent, so FDR won all but two states. In 1984, unemployment was seven percent, but that was lower than when Ronald Reagan took office, and it was headed down. And so Reagan asked Americans whether they were better off than they were four years ago, and Walter Mondale told them the answer didn’t matter because Reagan had run up huge deficits, and Reagan won 49 states.

Now Obama is in a similarly fortunate position. Most of the fiscal stimulus passed by Congress hasn’t kicked in yet, and it may not kick in time to save Democrats from grizzly results in next fall’s midterms. But Reagan got clobbered in the 1982 midterms as well, and it didn’t ultimately matter. If the economy is better in 2012 than it was in 2009, even if it’s not all that great, history suggests that Obama will reap the rewards and Republican arguments about deficits will work about as well as Mondale’s did.

It’s like giving Peyton Manning the ball at your own 20 yard line: there’s not a lot of suspense. Even this summer, when the press was announcing a dip in Obama’s fortunes, the health care bills were moving steadily through Congress, the stimulus was gradually slowing the nation’s economic descent, and Obama’s approval ratings never fell below 50 percent.

So liberals should stop complaining that Obama hasn’t done anything. Sure, he hadn’t yet done much to bring world peace, but the stimulus bill—which includes vast sums for college tuition, renewable energy and mass transit—is one of the most important pieces of progressive domestic legislation in decades. And if Obama twins that with health care reform, he’ll have done more to rebuild the American welfare state in one year than his two Democratic predecessors, Jimmy Carter and Bill Clinton, did in a combined twelve.

As for journalists, you can hardly blame them for trying to inject some volatility into the Obama storyline. But if this fall is any indication, much of the volatility will be imagined. The dreary truth is that politically, Obama is both lucky and good, and he’s well on his way to a successful first term. Oh, well. We still have Sarah Palin.

Peter Beinart, Senior Political Writer for The Daily Beast, is a Professor of Journalism and Political Science at City University of New York and a Senior Fellow at the New America Foundation

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4EU peace support work 'failing'

| |

The EU supports work in Afghanistan, among other countries |

The European Union's peace support efforts around the world have been heavily criticised in a new report.

Despite drawing on what is collectively the world's largest development budget, many countries, it says, fail to live up to the commitments they make.

The study is published by the European Council on Foreign Relations.

The findings are given added importance by the fact that the EU - if its Lisbon Treaty comes into force - could embark on major foreign policy reform.

'Civilian power'

From Afghanistan to the Horn of Africa, it is increasingly clear that it is the weakness of many countries that poses the greatest challenge to world order and stability.

Dealing with failed or failing states - identifying their problems early on and applying appropriate remedies - will be crucial.

The European Union certainly believes that this is an area where it has much to offer.

With a vast budget and human resources to draw upon, the EU sees itself as a "civilian power".

But, as the report from the European Council on Foreign Relations makes clear, the EU's track-record is mixed.

"This supposed civilian power," it says, "is largely illusory".

The EU struggles to find civilians to staff its missions and the results of its interventions, the report says, are often paltry.

Part of the problem is a failure to make good on commitments.

But the EU's initial experience in the Balkans - what the study calls "the Bosnia Template" - has weighed heavily on subsequent operations.

The report argues that the EU should rethink its whole approach to foreign interventions with a focus on speed, security and self-sufficiency.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Golden quarter for Goldman Sachs

The big investment firm posts another giant quarterly profit. CEO Blankfein: 'We are seeing improving conditions and evidence of stabilization.'

|

| Goldman chief Lloyd Blankfein: 'We are seeing improving conditions and evidence of stabilization.' |

|

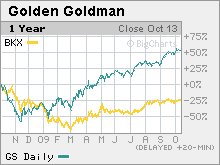

| Goldman shares have soared during this year's market rally. |

NEW YORK (Fortune) -- The Goldman Sachs steamroller keeps chugging along.

The big investment bank posted a $3.2 billion quarterly profit Thursday, crushing Wall Street estimates for the third straight quarter.

New York-based Goldman (GS, Fortune 500) made $5.25 a share, up from $1.81 a year ago and well above the $4.24 analysts surveyed by Thomson Financial were forecasting.

Goldman cited another strong quarter in its trading business, which has rebounded since the last half of 2008, when financial markets crumbled.

Revenue at the fixed income, currency and commodities business soared to $6 billion from $1.6 billion a year ago, while equities trading revenue soared to $1.85 billion from $354 million a year earlier.

"We are seeing improving conditions and evidence of stabilization, even growth, across a number of sectors," said CEO Lloyd C. Blankfein, in a statement.

Bonus pool keeps growing: But those profits don't come without public-relations issues.

The giant quarterly gain allowed Goldman to set aside $5.4 billion for employee compensation -- bringing its bonus pool to $16.7 billion through Sept. 30.

To critics, that number cries out for a reassessment of Goldman's priorities. Some small Goldman shareholders are sponsoring resolutions at next year's shareholder meeting that would have the board review the firm's pay practices.

"As prudent investors, we have a responsibility here to act as the conscience of Wall Street, especially when it fails to do so on its own," Laura Berry, executive director of the Interfaith Council on Corporate Responsibility, said in a statement Wednesday. "How is it possible that the year after billions of taxpayer dollars helped companies like Goldman Sachs return to financial health, this company shows absolutely no restraint?"

Blankfein last month said public anger over giant pay packages at money-losing firms is "understandable and appropriate." He stopped short of critiquing the pay practices at Goldman, where his compensation has routinely run to the tens of millions of dollars and the average employee is on track this year for an annual payout in the high six digits.

The money Goldman set aside for compensation through the first nine months of the year works out to an average of $526,814 for each of its 31,700 workers.

If the firm produces the strong fourth quarter Wall Street expects -- analysts at Deutsche Bank are forecasting a $3.6 billion profit and $4.4 billion in compensation costs -- average compensation could hit $662,000.

That's in line with the firm's payout in the record profit year of 2007, which closed before the global recession started in earnest.

David Viniar, Goldman's chief financial officer, said in response to repeated questions on a conference call with reporters Thursday morning that Goldman wouldn't make compensation decisions until year-end. He said Goldman would weigh the firm's performance as well as the economic climate and the market for top Wall Street workers.

"We're giving it a lot of thought," Viniar said. "We are very focused on what's going on in the world, but we want to be fair to our people, who have done a remarkably good job throughout the crisis."

Risk reduction: Goldman's profits came with a reduction in risk, judging by one estimate of the amount the firm could lose in a given trading day. Goldman's value at risk dropped to $208 million in the third quarter, from $245 million in the second quarter. Value at risk was $181 million in the year-ago third quarter.

The biggest reason for the decline in risk was a drop in the amount Goldman had riding on changes in interest rates. The firm stood to lose as much as $159 million on a given trading day in that area in the third quarter, down from $205 million in the second quarter.

Meanwhile, the firm's exposure to losses on stock trading climbed to $74 million from $60 million in the second quarter.

Thursday's report comes on the heels of another strong quarter from the banking world's other standout performer, JPMorgan Chase (JPM, Fortune 500). Its shares rose 3% Wednesday to a 52-week high after the New York-based bank said third-quarter profit rose sixfold.

Goldman shares are up 131% for the year, and are closing in on the $200 level for the first time since May 2008, as investors bet the firm's rebound from last fall's near collapse will continue. Shares were down 2% in early trading Thursday.

"The outlook for capital markets activity is mostly favorable for the industry, and even more favorable for Goldman Sachs given their positioning and recent market share gains," analysts at Deutsche Bank wrote in a note to clients last week. The firm rates Goldman stock a buy and has done underwriting work for the company.

While last fall's financial meltdown nearly brought down the global financial system, survivors like Goldman and JPMorgan have indeed prospered, thanks to the reduced competition and taxpayer support that followed. In addition to receiving multibillion-dollar Treasury loans that they have since repaid, both firms have benefited from taxpayer-subsidized funding via a federal debt guarantee program.

Goldman has paid back the $10 billion in bailout funds it received from the Troubled Asset Relief Program (TARP). But it was among the biggest recipients of taxpayer funds in last September's rescue of AIG (AIG, Fortune 500).

Goldman has also, in the aftermath of last year's implosion of onetime rivals Bear Stearns and Lehman Brothers, enjoyed the market perception that the government has judged it too big to fail -- leaning on what Harvard economist Kenneth Rogoff has called "the invisible wallet of the taxpayer." ![]()

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Robinho admits he dreams of playing for Barcelona as Thierry Henry is lined up for swap move to Manchester City Read more: http://www.dailymail.co.uk

Robinho says he would love to play alongside Barcelona's superstars at the Nou Camp.

The European champions want to sign the 25-year-old Manchester City forward in the winter transfer window and are preparing to offer Thierry Henry in part exchange.

And Robinho can hardly contain his glee at the prospect of joining up with the likes of Argentina playmaker Lionel Messi.

Perfect 10: Robinho is Barcelona's prime January target

'Of course I'd enjoy playing for Barca.' he told Spanish newspaper El Mundo Deportivo. 'Who wouldn't? We could have so much fun.

'It would be a pleasure to play alongside Messi, my compadre Dani Alves, Xavi, (Andres) Iniesta, (Zlatan) Ibrahimovic, with them all.

'They're a great team. I played against them and know their quality. But right now I can only do it on the PlayStation.'

The Brazil international insists neither he nor his agent - dad Gilvan de Souza - have been informed of any bid from Barcelona.

And though he says it would be 'wrong to talk about this hypothetical transfer' until there was formal offer, he could not resist heaping praise on the Catalans.

'It is a pleasure to see Barca play, they seem to be like Brazilians in how they use the ball. Pep Guardiola's team are real entertainers.'

Premier League return? France striker Thierry Henry could be offered to City

Nou Camp boss Guardiola has concerns about his left flank. The club failed in bids for several players during the summer window and wants to rectify the situation this winter.

Technical secretary Txiki Begiristain has already admitted that Robinho is an attractive option because he would not be cup-tied from the Champions League knock-out phase, unlike, for example, Arsenal's Andrey Arshavin.

Barca and City are understood to have discussed the transfer of Robinho when they met in a friendly at the Nou Camp in August, but they could not come to an agreement.

Ambitious: Robinho says Manchester City have built a squad to win the title

City were told that a part-exchange for Messi was out of the question and the 22-year-old has since signed a new contract to 2016 with a buy-out clause of £230million.

But other players understood to have been mentioned were former Arsenal star Henry and veteran captain Carles Puyol.

It is suggested that Mark Hughes would not be averse to losing Robinho, but the club's ambitious owners would want a player of similar stature in return, and Henry fits the bill.

Robinho was the Abu Dhabi money men's impact signing on the day their buy-out was revealed in September 2008. City shelled out a British record £34m to take him from Real Madrid when it seemed he had been bound for Chelsea.

Barca would pay a similar figure to take him back to Spain, though they would want him to join initially on loan for the remainder of this season, once the transfer window re-opens.

It is clear Robinho relishes the prospect, though he insists that there is a long way to go before a deal is done.

'It is not a question of being loaned or transferred, whether in the winter or the summer,' he said. 'It is a matter of sitting down and talking about it when there is a concrete offer, which, I repeat, I am not personally aware of.

'When that happens, we can talk. I don't want to be misinterpreted. It is clear that I have a contract with City and I owe it to them to be professional.

'It's no secret that there was clear interest from Barca (in the summer), but Manchester City would not enter negotiations.

'I believed that I was not transferable and so I focussed on doing my best for City. We are thinking big, we have built a very strong team aiming to win the Premier League with (Carlos) Tevez, (Emmanuel) Adebayor, (Joleon) Lescott and (Gareth) Barry.'

Champion: Barca head coach Pep Guardiola is held aloft by his players after leading the side to Champions League glory against Manchester United in May

But he has other team-mates who would like to see him at the Nou Camp. Brazil and Barca full back Dani Alves says Robinho would be very welcome and would give the team different options.

And Robinho replied: 'Dani is a phenomenon. With Alves I have very good vibes. I am delighted with how well he has done at Barca. He deserves it, he's a great guy and excellent footballer.

'I am still up to date with Spanish football and left many friends in Spain. When I meet with many of them in the Brazil team we talk at length. We are used to exchanging text messages or calling each other.'

Alves is not the only one who wins praise. Told he was admired by Guardiola, Robinho responded: 'It is an honour that a coach such as him speaks highly of Robinho. I read that he values me. I thank him from the heart.'

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Classless Maradona unloads on media after Argentina qualify

Diego Maradona was criticized a great deal and Wednesday was his day to sound off. His painful win allowed him to truly say what he had in mind to his detractors and critics.

Known for being emotionally extremist, insulting, and abhorringly arrogant, the Argentine national coach has once again struck a nerve in the collective mindset of the soccer world after his actions in the post-game press conference after Argentina defeated Uruguay 1-0 and qualified directly to the 2010 World Cup in South Africa.

Here are some of his pearls of wisdom from the postgame press conference:

"I had support. There were no problems. Dalma and Giannina always told which of you were mother**** and which ones weren't motherf****s."

"This goes to those who did not believe in the national team. Those of you that treated me like a (piece of) garbage. Today we are in the World Cup with no one's help, with all the accolades, beating a great team like Uruguay. To those of you that didn't believe in me, you can suck my d***. I am black or white, never gray. Those of you who treated me that way, suck my d***."

"I am going to make several criticisms, but I am going to do them on my own, not with you all as you have alredy made them. I took on the role of head coach to help the team move forward and today I became a coach."

He even took personal shots at individual journalists present, especially one that questioned his hug with former national team coach and current manager Carlos Salvador Bilardo. "(The press) made up a story that I was fighting with Bilardo, that we would not see each other. We are always together at the (Ezeiza) complex. If (the press) want to continue exchanging false information, that is your problem."

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Fiorentina Sporting Director Pantaleo Corvino Defends Adrian Mutu

The Italian club official believes the press are too harsh on the 30-year-old. He has stated that the Romanian's "indiscretions" have little to do with life on the football field...

Fiorentina and Romania striker Adrian Mutu has been embroiled in more controversy, resulting in the player being criticised in the press, but Viola sporting director Pantaleo Corvino has quickly defended his man. The former Chelsea player was caught clubbing a few days before a World Cup qualifier against Serbia, which his team lost 5-0. Reports emerged that coach Razvan Lucescu had taken a decision to ban Mutu from the squad, but they later turned out to be false. Corvino has defended the player, suggesting that Mutu is being attacked unjustly in the press. "When he comes back from his national team there is always some kind of controversial aftermath," he told Sky Sport 24. "I feel sorry for him, because his indiscretions have little to do with football, but his professionalism is constantly attacked." Mutu is expected to start this Saturday's high-profile clash against Juventus.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Nokia swings to surprise loss in Q3

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Muslim rebels deny holding Irish priest

ZAMBOANGA CITY, Philippines—The Moro Islamic Liberation Front on Thursday denied that one of its commanders was holding a kidnapped Irish priest, while insisting it wanted to help rescue him.

The military said a notorious pirate had kidnapped Father Michael Sinnott, 79, from his home in the southern Philippines on Sunday and may have passed him on to a local commander for MILF.

It also said Wednesday that Sinnott was being held in a remote area that is known to be an MILF stronghold.

"We do not deny the fact that there is a presence of the MILF in the area and an MILF community there but it is not true that the MILF is holding the priest," the group's spokesman, Eid Kabalu, said in response on Thursday.

Kabalu also said the MILF was sending an emissary to Sultan Naga Dimaporo town, where the military said Sinnott was being held, to check if the priest was really there and try to secure his release.

"We are ready to intervene and operate for the possible recovery of the priest. We have already mobilized our men on the ground to do whatever action is necessary," he said.

Six armed gunmen kidnapped Sinnott on Sunday night from his home at the Missionary Society of Saint Columban compound in Pagadian City on southern Mindanao island.

There are fears Sinnott may be used to extract a ransom, either by the pirate or whomever he passes the priest on to.

Aside from the MILF, the Muslim militant Abu Sayyaf group and armed gangs such as the one run by the pirate, Guingona Samal, operate in the area.

The government and the MILF have had a ceasefire in place since 2005 and the two sides are due to resume peace talks soon.

The MILF, which has been fighting for an independent Muslim homeland in the south of this Roman Catholic country since 1978, has said it had no interest in abducting Sinnott because that would jeopardize peace talks.

There is concern over Sinnott's health as he had quadruple heart bypass surgery in 2005 and needs constant medication.

Sinnott has spent about 40 years in the Philippines, first arriving in Mindanao in 1957 as a missionary. After a stint elsewhere, he came back to the Philippines in 1976 and never left.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4India-Russia defence ties evolving from buyer-seller to a broadbased partnership

Moscow, Oct 15 (ANI): Defence Minister A K Antony has said that over the years defence relations between India and Russia have evolved from a simple buyer-seller relationship to a broadbased partnership where both countries are involved in joint design, development and production of defence equipment.

Antony said this at the 9th Meeting of the India-Russia Inter-Governmental Commission on Military Technical Cooperation (IRIGC-MTC), which began here on Wednesday.

Antony and his Russian counterpart Anatoly Serdyukov chaired the meeting.

Taking note of the structured mechanisms for defence interactions with Russia, Antony said that Russia is the only country with which India has such a well-established multi-tiered mechanism, which has contributed to the strengthening of bilateral ties.

Describing Russia as a time tested and dependable friend of India, he said: "India and Russia have an enduring strategic partnership and defence ties."

The IRIGC-MTC meeting reviewed the status of various ongoing bilateral defence cooperation projects.

A protocol highlighting the various aspects of these projects was signed at the conclusion of the two-day meeting.

Both sides reiterated the commitment of the Governments to extend the ongoing programme of military technical cooperation for a further ten years, from 2011 to 2020.

Antony and Serdyukov expressed the hope that the Inter-Governmental Agreement in this regard would be signed during the Prime Minister Dr. Manmohan Singh's visit to Moscow in December for the India-Russia Summit.

Both sides also resolved that an Agreement on after-sales product support of Russian origin defence equipment held by the Indian Armed Forces would be signed during the forthcoming Summit.

The Indian delegation to the two-day IRIGC-MTC meeting included Defence Secretary Pradeep Kumar, Secretary (Defence Production) Raj Kumar Singh and other senior officials of the Ministry of Defence and the Armed Forces.Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Sandeep scores four but Canada holds India to draw

Sandeep Singh scored four times but Canada took advantage of a fragile Indian defence to stage a late comeback and hold the visitors to a 4-4 draw in the third Test of the seven-match hockey series at the Tamanawis Park here.

Sandeep flicked home in the ninth, 18th, 31st and 45th minutes while Scott Tupper (second), Rob Short (66th) and Mark Pearson (68th and 70th min) scored for Canada, last night.

However, India continues to lead the series 2-0. Canada began aggressively and took an early lead when the Indian defence conceded a soft penalty corner in the second minute which was sunk in by Tupper to goalkeeper Adrian D'Souza's right.

Rattled by this reversal, India took a firm grip on the proceedings soon after with forays from both flanks.

The midfielders led by skipper Tushar Khandker propelled the forwards Shivendra Singh, Rajpal Singh and Gurwinder Chandi to move cohesively in the Canadian danger zone for a look in.

A physical tackle by Scott Sandison on Rajpal Singh within the Canadian quarter line gave India their first penalty corner from which Sandeep levelled the score.

Sandeep scored again nine minutes later after Shivendra was brought down by Canada's Gabbar Singh. India continued to hold sway with Khandker, Dhananjay Mahadik and Arjun Halappa constantly moving upfront in tandem with the forwards.

Sandeep completed his hat trick off a scorcher past custodian David Carter in the 31st minute after striker Roshan Minz found the foot of a Canadian defender.

Canada came close to reducing the margin shortly before the break but a penalty corner attempt by Tupper was wide and Rob Short's open attempt was well anticipated by D'Souza.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4GLOBAL MARKETS-Asia shares hit 14-mth highs; dollar slides

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4GAZA: Farmers struggle with damaged agricultural land

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Putin wants song contest with China, C.Asia allies

MOSCOW: Russian Prime Minister Vladimir Putin proposed to Chinese and Central Asian leaders on Wednesday holding a joint song competition called "Intervision" to rival the Eurovision Song Contest.

Such an event would see Chinese crooners competing for a prize with Uzbeks, Tajiks, Kazakhs, Russians and Kyrgyz.

MOSCOW: Russian Prime Minister Vladimir Putin proposed to Chinese and Central Asian leaders on Wednesday holding a joint song competition called "Intervision" to rival the Eurovision Song Contest.

Such an event would see Chinese crooners competing for a prize with Uzbeks, Tajiks, Kazakhs, Russians and Kyrgyz. "Conducting an international modern song contest, Intervision, would strengthen cultural ties between our nations", Interfax news agency quoted Putin as telling a meeting of the Shanghai Cooperation Organisation (SCO) heads of government in Beijing.

It was not immediately clear whether Iran, India, Mongolia and Pakistan, which have SCO observer status, would take part.

The annual Eurovision contest started in 1956 and reaches a TV audience of some 100 million, despite its reputation in many countries as a celebration of kitsch.

Countries in and near Europe enter a song and the winner is decided through a lengthy voting process which sometimes appears to be based on geopolitical factors rather than musical merit. Moscow hosted the contest last May.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Gov’t raises P300B deficit scenario

Finance secretary Margarito Teves yesterday said the government is looking at a worse-case scenario budget deficit of P300 billion from the current "difficult- to-defend" P250 billion target representing 3.2 percent of the gross domestic product.

Teves said he is finding it "extremely stressful and extremely difficult" to contain the targeted funding shortfall, considering the additional spending required for typhoon rehabilitation efforts and delays in privatization of state assets.

"In a worse-case scenario, of course, the deficit could reach P300 billion. But it remains as a worse-case scenario. We are sticking with our programmed deficit," he said.

A P300 billion deficit, representing 3.96 percent of the GDP, has long been forecast by most foreign banks, multilateral creditors and global credit rating agencies.

The budget deficit is to expand by at least P12 billion, representing the supplemental budget Congress is expected to pass to fund rehabilitation efforts in the wake of typhoons "Ondoy" and "Pepeng."

Teves said no matter how difficult it is, the finance department and the rest of the economic team are sticking to the P250 billion ceiling, which is now in its third revised form.

He said the deficit scenario will hopefully get a boost with the privatization of three more assets in the last quarter led by Food Terminals Inc. (FTI).

Last week’s bidding for FTI was declared a failure after no one showed up to bid. As a result government is looking at a negotiated sale.

The government expects to raise P30 billion from the privatization of FTI, sale of a 40 percent shareholding at PNOC-EC and the lease of the Fujimi property in Japan.

The government also wants to sell its contested shares in San Miguel Corp., valued at P50 billion, but needs Supreme Court approval to do so.

"We want to continue selling assets," he said.

Teves likewise indicated continued discussions on visiting the global capital markets for the third time for a possible $500 million bond float.

He said plans are firming up to tap the Japanese capital markets for $500 million to $1 billion in yen-denominated bonds that would be guaranteed by Japan Bank for International Cooperation (JBIC).

The government earlier reported that it is nearing closing a deal on lowering the guarantee fee being charged by JBIC in exchange for providing 95 percent risk cover for the Samurai bond float.

Teves earlier said the preferred route is to launch global bonds in the remaining months of the year while deferring the Samurai float to early next year.

The finance chief also expressed doubts full-year growth target of 0.8 percent to 1.8 percent could be achieved, saying the devastation wrought by the typhoons could push back the GDP growth rate to a range of 0.6 percent to 1.6 percent from the current target range of 0.8 percent to 1.8 percent.

Teves estimated the damage caused by Ondoy and Pepeng at between P12 billion to P14 billion.

According to him, a damage of P7 billion is enough to bring clip 0.1 percent from the growth rate.

The country grew by a disappointing 0.4 percent in the first quarter but recovered slightly in the second quarter with a growth

of 1.5 percent.

The second quarter GDP performance prompted foreign banks and global economic think tanks to tweak their growth forecast to between 1 percent and 3 percent.

Teves said dollar remittances from Filipinos abroad may still help the government achieve better growth rates after rising to $1.5 billion in July from $1.4 billion in the same period in 2008.

The Bangko Sentral ng Pilipinas (BSP) said dollar remittances from overseas workers could reach $17.1 billion from $16.4 billion last year or an expansion of 4 percent.

Teves said another "compensating factor" is the plan to seek multilateral help for typhoon relief from donor agencies attending the 2009 Philippine Development Forum (PDF) in the middle of November.

"We’re going to convert the PDF into a pledging session and seek the help of multilateral agencies," he said.

The DOF has been assigned as lead agency in the reconstruction commission that the President created to focus on raising funds or donations from the international community.

In the coming PDF forum, Teves said, the government may enter into bilateral agreements for "donations in kind" and seek grants and financial aid from multilateral lenders.

The government’s budget deficit has swelled to P210 billion as of end-August, only P40 billion shy of the full-year programmed ceiling and almost seven times more than the P31.7 billion deficit incurred in the same period last year.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Dollar falls to 14-month lows vs Aussie, euro

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Thai king's condition "good", recovery needed - palace

BANGKOK (Reuters) - Thai King Bhumibol Adulyadej's condition is "good" but he needs time to recover from pneumonia, the palace said on Wednesday after concerns over his health sparked a tumble in Thailand's financial markets.

The king, the world's longest-reigning monarch and Thailand's single unifying figure, is regarded as semi-divine by many of the country's 63 million people. His health is an extremely sensitive topic.

|

Well-wishers pray for King Bhumibol Adulyadej at Siriraj Hospital in Bangkok in this September 22, 2009 file photo. (REUTERS/Chaiwat Subprasom/Files) |

Thai stock prices and the local baht currency fell sharply on Wednesday on concerns over his condition.

"His majesty the king's general condition is good," said a statement from the Bureau of the Royal Household after markets had closed. "However, a further period of recovery of lung pneumonia is necessary, as in the case of the elderly."

King Bhumibol, 81, has been in hospital since Sept. 19, making this his longest period of treatment since suffering a blood clot in 2007.

The statement said he would stay in hospital for "continuous rehabilitation therapies", the first suggestion he could remain in hospital for some time.

Over the past few weeks many Thais have gathered at Siriraj Hospital where he is being treated to sign get-well books for the king or lay garlands in front of a monument of Prince Mahidol of Songkla, the king's father, to pray for a speedy recovery.

Strict lese majeste laws in Thailand make comment on royal matters risky.

The king's condition is followed closely in financial markets, in part because of concerns about succession. Bhumibol's son and presumed heir, Crown Prince Vajiralongkorn, does not command his father's popular support.

A focus on the issue of royal succession would add another element of uncertainty to a polarising four-year political crisis that has put a squeeze on foreign investment in Southeast Asia's second-biggest economy.

Underlining that, the cost of insuring Thailand's sovereign debt rose on Wednesday, with five-year credit default swaps climbing 5 basis points to 89.8 bps, CDS monitor CMA Datavision said. Credit default swaps (CDS) are used by investors to insure against the risk of debt default or restructuring.

Thai stocks slid more than 4 percent, led by foreign selling, before recouping some ground to end down 2.04 percent. The baht currency fell, trading at 33.46 per dollar against an intraday high of 33.20 earlier.

The king's health also made headlines last December at his 81st birthday, when he failed to give his traditional address to the nation. His daughter, Crown Princess Maha Chakri Sirindhorn, said then that he had a throat infection and was on a saline drip.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4P50B bond float eyed for rehab

PRESIDENT Arroyo yesterday said the government plans to float reconstruction bonds, likely through stated-owned National Development Co. (NDC), to help finance the rehabilitation of places ravaged by storm "Ondoy" and typhoon "Pepeng."

"Depending on the recommendation of the Special (Reconstruction) Commission, we may issue reconstruction bonds. I have already discussed this with Trade Secretary Peter Favila, who supervises the NDC, which seems to be the favorite recommendee of economic managers and business leaders as far as issuance of bonds is concerned," Arroyo said during yesterday’s mid-year Philippine Economic Briefing at the Shangri-la Hotel in Makati City.

Favila, after the briefing, placed the planned float at P50 billion.

Arroyo said it is best that NDC do the bond flotation because the global crisis has strained the national government’s capacity for direct borrowing.

She said government’s response to the most recent calamities that devastated Luzon "cannot just be another borrowing program."

"We don’t want to let grant opportunities go to waste. And even if we resort to bonds in bringing in exogenous resources, we will go beyond a mere borrowing program to provide a developing framework that is required by official development assistance programs," she said.

Budget Secretary Rolando Andaya Jr. supported the borrowing option, saying the government cannot use the proceeds from the sale of banked natural gas in Malampaya to finance the P12 billion additional calamity budget being finalized in both houses of Congress.

Andaya Jr. said the government would resort to fresh loans to fund the additional budget.

Andaya said the additional P12 billion will be included in the unprogrammed funding item in the 2009 budget amounting to P75.9 billion as it could not be treated as a supplemental budget for lack of an accompanying revenue measure.

Finance Margarito Teves said funding for the P12 billion additional budget would be sourced from a combination of local and foreign borrowings or from "re-allocated" funds in the unprogrammed items.

"There are many ways of handling this," he said.

Andaya also disclosed that DBM is seeking a last-minute P50 billion insertion in the proposed national budget for 2010 to cover expenditures for massive infrastructure work needed after the typhoons.

Andaya said the budget increase will be reflected in the capital outlay component of the budget for next year, which will see an increase of P50 billion to P233 billion from the proposed P183 billion.

The insertion will effectively restore the capital outlay to its 2009 level of P233 billion, he said.

Andaya said Malacañang will introduce the P50-billion increase possibly at the bicameral level.

Andaya said the additional appropriation will bloat the proposed P1.541 trillion budget by another P50 billion.

At the Senate, senators voted 16-0-0 Tuesday night to approve the proposed P12 billion emergency fund.

During deliberations, Angara accepted an amendment seeking to create a congressional oversight panel of five senators and five congressmen, co-chaired by the chairmen of the Senate finance committee and the House appropriations committee.

Enrile paid tribute to the Senate minority bloc for successfully placing in the resolution a strict reporting system on the disbursement and use of the fund by the line agencies through the National Disaster Coordinating Council.

The unanimous vote also came after Defense Secretary Gilbert Teodoro, chair of the NDCC, gave the assurance that he will be leaving the defense department and the NDCC "before the first disbursement of the emergency fund."

Teodoro is the administration’s 2010 presidential candidate and critics have raised fears he would use the P12 billion to advance his candidacy.

Teodoro’s assurance was conveyed through Sen. Aquilino Pimentel Jr. who said he had expressed to Teodoro his apprehension that the latter would be a beneficiary of the multi-billion emergency fund.

Today, President Arroyo will convene the Legislative-Executive Development Advisory Council to take up measures on relief and reconstruction.

On Oct. 30, she is expected to sign into law the Disaster Risk Reduction Bill.

An official of the Catholic Bishops Conference of the Philippines (CBCP) called on lawmakers to make sure there are enough safeguards in the budget being pushed for the augmentation of the government’s calamity funds.

Bishop Broderick Pabillio, CBCP National Secretariat for Social Action chairman, said the additional budget might go straight to the pockets of politicians.Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Free samples of snacks a common marketing tool in Japan

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Earnshaw faces month on sidelines

Earnshaw scored 17 goals for Forest last season |

Nottingham Forest could be without striker Robert Earnshaw for up to four weeks after he suffered a calf injury while on World Cup duty with Wales.

Earnshaw was hurt while training ahead of the World Cup qualifier in Finland.

Forest have six strikers competing for two spots and Earnshaw has started only two league games so far this season.

Dexter Blackstock and David McGoldrick have been the most regular starters while Nathan Tyson and Joe Garner have been deployed on the wing.

Former Birmingham and Bristol City forward Dele Adebola has been mainly used as a substitute.

Full Video | Part 1 | part 2 l part3

More

Full video ! Part1 / part2 / part3 / part4Blogger Templates created by Deluxe Templates

Wordpress Web Hosting on Templatelite.com