The big investment firm posts another giant quarterly profit. CEO Blankfein: 'We are seeing improving conditions and evidence of stabilization.'

|

| Goldman chief Lloyd Blankfein: 'We are seeing improving conditions and evidence of stabilization.' |

|

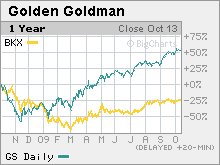

| Goldman shares have soared during this year's market rally. |

NEW YORK (Fortune) -- The Goldman Sachs steamroller keeps chugging along.

The big investment bank posted a $3.2 billion quarterly profit Thursday, crushing Wall Street estimates for the third straight quarter.

New York-based Goldman (GS, Fortune 500) made $5.25 a share, up from $1.81 a year ago and well above the $4.24 analysts surveyed by Thomson Financial were forecasting.

Goldman cited another strong quarter in its trading business, which has rebounded since the last half of 2008, when financial markets crumbled.

Revenue at the fixed income, currency and commodities business soared to $6 billion from $1.6 billion a year ago, while equities trading revenue soared to $1.85 billion from $354 million a year earlier.

"We are seeing improving conditions and evidence of stabilization, even growth, across a number of sectors," said CEO Lloyd C. Blankfein, in a statement.

Bonus pool keeps growing: But those profits don't come without public-relations issues.

The giant quarterly gain allowed Goldman to set aside $5.4 billion for employee compensation -- bringing its bonus pool to $16.7 billion through Sept. 30.

To critics, that number cries out for a reassessment of Goldman's priorities. Some small Goldman shareholders are sponsoring resolutions at next year's shareholder meeting that would have the board review the firm's pay practices.

"As prudent investors, we have a responsibility here to act as the conscience of Wall Street, especially when it fails to do so on its own," Laura Berry, executive director of the Interfaith Council on Corporate Responsibility, said in a statement Wednesday. "How is it possible that the year after billions of taxpayer dollars helped companies like Goldman Sachs return to financial health, this company shows absolutely no restraint?"

Blankfein last month said public anger over giant pay packages at money-losing firms is "understandable and appropriate." He stopped short of critiquing the pay practices at Goldman, where his compensation has routinely run to the tens of millions of dollars and the average employee is on track this year for an annual payout in the high six digits.

The money Goldman set aside for compensation through the first nine months of the year works out to an average of $526,814 for each of its 31,700 workers.

If the firm produces the strong fourth quarter Wall Street expects -- analysts at Deutsche Bank are forecasting a $3.6 billion profit and $4.4 billion in compensation costs -- average compensation could hit $662,000.

That's in line with the firm's payout in the record profit year of 2007, which closed before the global recession started in earnest.

David Viniar, Goldman's chief financial officer, said in response to repeated questions on a conference call with reporters Thursday morning that Goldman wouldn't make compensation decisions until year-end. He said Goldman would weigh the firm's performance as well as the economic climate and the market for top Wall Street workers.

"We're giving it a lot of thought," Viniar said. "We are very focused on what's going on in the world, but we want to be fair to our people, who have done a remarkably good job throughout the crisis."

Risk reduction: Goldman's profits came with a reduction in risk, judging by one estimate of the amount the firm could lose in a given trading day. Goldman's value at risk dropped to $208 million in the third quarter, from $245 million in the second quarter. Value at risk was $181 million in the year-ago third quarter.

The biggest reason for the decline in risk was a drop in the amount Goldman had riding on changes in interest rates. The firm stood to lose as much as $159 million on a given trading day in that area in the third quarter, down from $205 million in the second quarter.

Meanwhile, the firm's exposure to losses on stock trading climbed to $74 million from $60 million in the second quarter.

Thursday's report comes on the heels of another strong quarter from the banking world's other standout performer, JPMorgan Chase (JPM, Fortune 500). Its shares rose 3% Wednesday to a 52-week high after the New York-based bank said third-quarter profit rose sixfold.

Goldman shares are up 131% for the year, and are closing in on the $200 level for the first time since May 2008, as investors bet the firm's rebound from last fall's near collapse will continue. Shares were down 2% in early trading Thursday.

"The outlook for capital markets activity is mostly favorable for the industry, and even more favorable for Goldman Sachs given their positioning and recent market share gains," analysts at Deutsche Bank wrote in a note to clients last week. The firm rates Goldman stock a buy and has done underwriting work for the company.

While last fall's financial meltdown nearly brought down the global financial system, survivors like Goldman and JPMorgan have indeed prospered, thanks to the reduced competition and taxpayer support that followed. In addition to receiving multibillion-dollar Treasury loans that they have since repaid, both firms have benefited from taxpayer-subsidized funding via a federal debt guarantee program.

Goldman has paid back the $10 billion in bailout funds it received from the Troubled Asset Relief Program (TARP). But it was among the biggest recipients of taxpayer funds in last September's rescue of AIG (AIG, Fortune 500).

Goldman has also, in the aftermath of last year's implosion of onetime rivals Bear Stearns and Lehman Brothers, enjoyed the market perception that the government has judged it too big to fail -- leaning on what Harvard economist Kenneth Rogoff has called "the invisible wallet of the taxpayer." ![]()

No comments:

Post a Comment